Finance Through the Cloud

There is no shortage of places where financial service companies could see improvement through the cloud. Like most other industries, the way higher-end resources can be readily acquired can help improve agility and cost efficiency while dealing with the flow of traffic. From additional tools to security, AWS is an excellent platform for building finance-related applications and operations.

One of AWS’ key features is scalability and adaptability to size, scale, and industry. From local banks to banking organizations that operate at a national or even international scale, AWS’ IT infrastructure can be made to scale up or down to encroaching needs. Infrastructure can be individually adjusted to provide customers with the best experience they can possibly get. More importantly, this is good for making applications and operations cost-effective and avoids overprovisioning.

Finance Through the Cloud

There is no shortage of places where financial service companies could see improvement through the cloud. Like most other industries, the way higher-end resources can be readily acquired can help improve agility and cost efficiency while dealing with the flow of traffic. From additional tools to security, AWS is an excellent platform for building finance-related applications and operations.

One of AWS’ key features is scalability and adaptability to size, scale, and industry. From local banks to banking organizations that operate at a national or even international scale, AWS’ IT infrastructure can be made to scale up or down to encroaching needs. Infrastructure can be individually adjusted to provide customers with the best experience they can possibly get. More importantly, this is good for making applications and operations cost-effective and avoids overprovisioning.

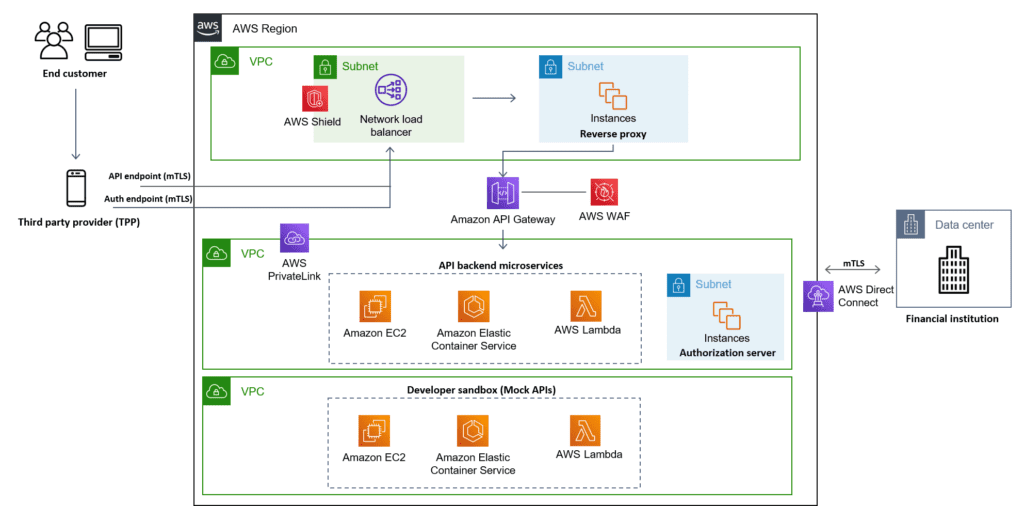

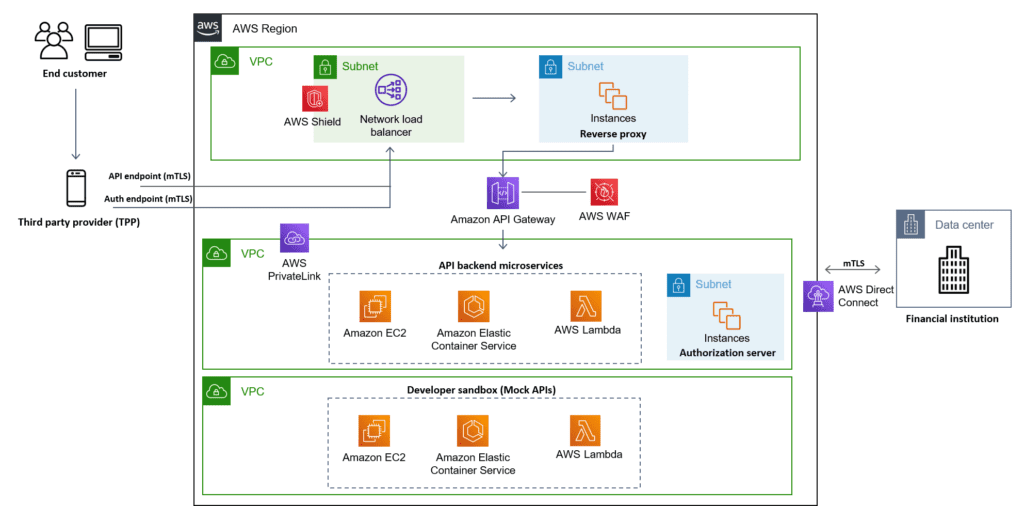

If security on the cloud is a concern, there are options for hybrid setups to allow for physical security and a number of other security tools on AWS. These aws financial services usually provide data encryption, permissions and access controls for making accounts for management or customers, and threat detection to stop infiltrations in their tracks before the damage is done. AWS meets a number of industry security standards, such as SOC1, SOC2, and PCI DSS. If anything, AWS services will further improve existing security for any financial firm.

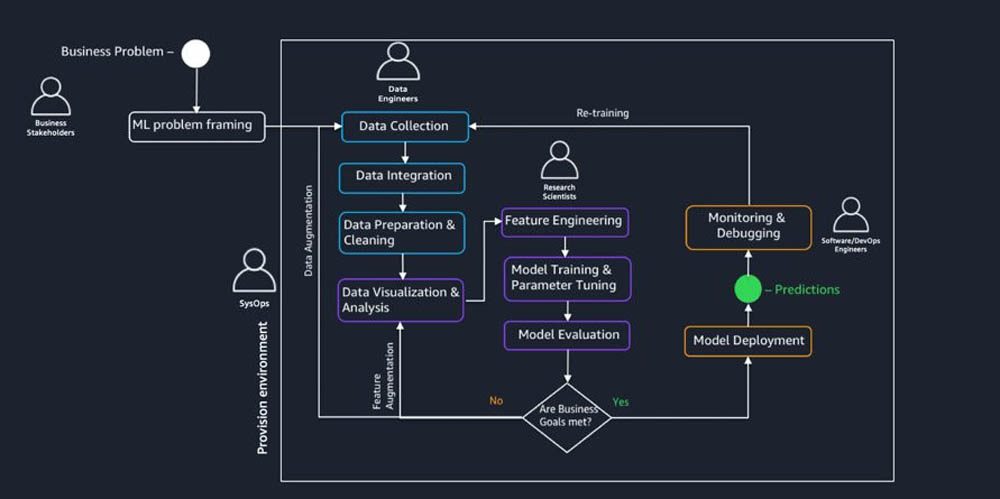

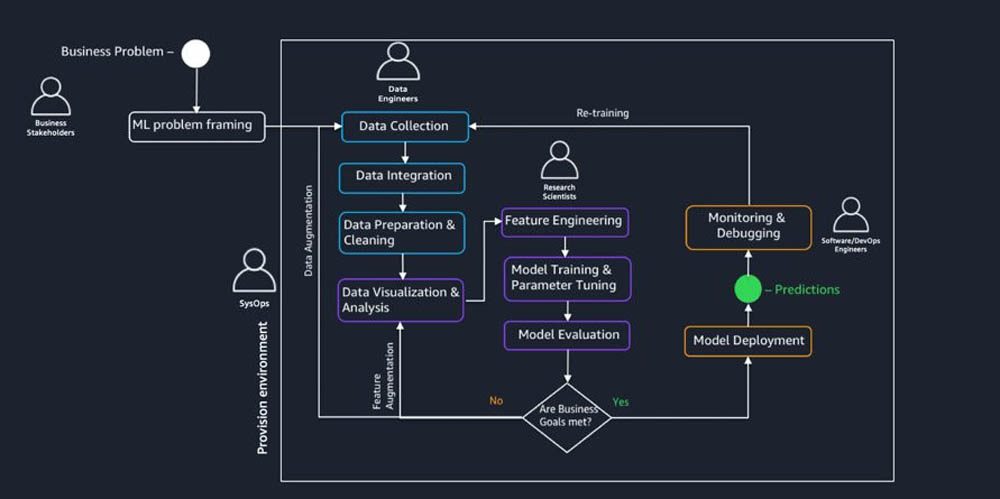

But above all else, AWS is on the cusp of cutting edge machine learning and AI technologies. As one of the longest-running cloud providers, they have gradually improved their AI functionality and have provided more services utilizing them. It serves as the backbone of all AWS features from fraud detection to risk management and better customer segmentation to help employees organize faster.

If security on the cloud is a concern, there are options for hybrid setups to allow for physical security and a number of other security tools on AWS. These aws financial services usually provide data encryption, permissions and access controls for making accounts for management or customers, and threat detection to stop infiltrations in their tracks before the damage is done. AWS meets a number of industry security standards, such as SOC1, SOC2, and PCI DSS. If anything, AWS services will further improve existing security for any financial firm.

But above all else, AWS is on the cusp of cutting edge machine learning and AI technologies. As one of the longest-running cloud providers, they have gradually improved their AI functionality and have provided more services utilizing them. It serves as the backbone of all AWS features from fraud detection to risk management and better customer segmentation to help employees organize faster.

By Industry

IT for financial services is already important enough with the amount of risk at play. Here’s how AWS can be applied for specific parts of finance:

Banking

The primary goal for banking on AWS is to increase overall revenue, minimize costs, improve overall the customer experience, and maintain confidentiality. With financial concerns such as credit score accuracy or financial crimes, AWS can help improve the flow of information through intelligence and automation. As the market shifts and new technologies and regulations are introduced into the field, the cloud provides options for rapid modernization. Data and analytics will not only strengthen customer relations but provide customers with more accurate information to work with.

Capital Markets

With how AWS handles data, there are ways to improve how research and risk are evaluated and how surveillance and reporting are conducted. The cloud is better suited to reallocating resources for higher-value jobs and reducing technical debt along with the AWS standard of agility and scalability. The way the cloud can minimize costs can help improve risk evaluation further than previously thought possible. Taking in heaps of customer data, offers can be summarily spun in ways buyers will find much more appealing.

By Industry

IT for financial services is already important enough with the amount of risk at play. Here’s how AWS can be applied for specific parts of finance:

Banking

The primary goal for banking on AWS is to increase overall revenue, minimize costs, improve overall the customer experience, and maintain confidentiality. With financial concerns such as credit score accuracy or financial crimes, AWS can help improve the flow of information through intelligence and automation. As the market shifts and new technologies and regulations are introduced into the field, the cloud provides options for rapid modernization. Data and analytics will not only strengthen customer relations but provide customers with more accurate information to work with.

Capital Markets

With how AWS handles data, there are ways to improve how research and risk are evaluated and how surveillance and reporting are conducted. The cloud is better suited to reallocating resources for higher-value jobs and reducing technical debt along with the AWS standard of agility and scalability. The way the cloud can minimize costs can help improve risk evaluation further than previously thought possible. Taking in heaps of customer data, offers can be summarily spun in ways buyers will find much more appealing.

Insurance

Insurance has historically been a data-driven industry and needs ways to constantly modernize, whether it be through launching new applications or utilizing that data to better serve customers. The ideal goal is to completely replace older solutions with something that is not only more cost-effective and agile but to do it completely from actuarial systems to how records are established. For example, being able to automate the process for claims, underwriting, and conducting service would ease matters for both provider and customer alike. Many of the emerging technologies that Amazon is already making extensive use of can further assist customers in ways that are faster and aimed more accurately at what they need.

Payments and Protection

Fraud is going to be a perpetually evolving crime and the finance industry needs the right tools to remain prepared to handle fraud attempts. Along with having the infrastructure that is resilient enough to handle incoming threats, there should be measures in place to detect and prevent fraudulent payments. To extend safer means for customers to make payments, the open API nature of AWS allows developers to embed payments or provide instant funding options for customers.

Third-Party Assistance

AllCode is a Select AWS Partner with several AWS specialists and professionals on our team. We have had extensive AWS experience in the past working with different clients to produce a number of applications and projects on the Amazon Cloud. If this is something you see helping your business operations, we would be more than happy to discuss this matter further.

Insurance

Insurance has historically been a data-driven industry and needs ways to constantly modernize, whether it be through launching new applications or utilizing that data to better serve customers. The ideal goal is to completely replace older solutions with something that is not only more cost-effective and agile but to do it completely from actuarial systems to how records are established. For example, being able to automate the process for claims, underwriting, and conducting service would ease matters for both provider and customer alike. Many of the emerging technologies that Amazon is already making extensive use of can further assist customers in ways that are faster and aimed more accurately at what they need.

Payments and Protection

Fraud is going to be a perpetually evolving crime and the finance industry needs the right tools to remain prepared to handle fraud attempts. Along with having the infrastructure that is resilient enough to handle incoming threats, there should be measures in place to detect and prevent fraudulent payments. To extend safer means for customers to make payments, the open API nature of AWS allows developers to embed payments or provide instant funding options for customers.

Third-Party Assistance

AllCode is a Select AWS Partner with several AWS specialists and professionals on our team. We have had extensive AWS experience in the past working with different clients to produce a number of applications and projects on the Amazon Cloud. If this is something you see helping your business operations, we would be more than happy to discuss this matter further.

Finance Through the Cloud

There is no shortage of places where financial service companies could see improvement through the cloud. Like most other industries, the way higher-end resources can be readily acquired can help improve agility and cost efficiency while dealing with the flow of traffic. From additional tools to security, AWS is an excellent platform for building finance-related applications and operations.

One of AWS’ key features is scalability and adaptability to size, scale, and industry. From local banks to banking organizations that operate at a national or even international scale, AWS’ IT infrastructure can be made to scale up or down to encroaching needs. Infrastructure can be individually adjusted to provide customers with the best experience they can possibly get. More importantly, this is good for making applications and operations cost-effective and avoids overprovisioning.

Finance Through the Cloud

There is no shortage of places where financial service companies could see improvement through the cloud. Like most other industries, the way higher-end resources can be readily acquired can help improve agility and cost efficiency while dealing with the flow of traffic. From additional tools to security, AWS is an excellent platform for building finance-related applications and operations.

One of AWS’ key features is scalability and adaptability to size, scale, and industry. From local banks to banking organizations that operate at a national or even international scale, AWS’ IT infrastructure can be made to scale up or down to encroaching needs. Infrastructure can be individually adjusted to provide customers with the best experience they can possibly get. More importantly, this is good for making applications and operations cost-effective and avoids overprovisioning.

If security on the cloud is a concern, there are options for hybrid setups to allow for physical security and a number of other security tools on AWS. These aws financial services usually provide data encryption, permissions and access controls for making accounts for management or customers, and threat detection to stop infiltrations in their tracks before the damage is done. AWS meets a number of industry security standards, such as SOC1, SOC2, and PCI DSS. If anything, AWS services will further improve existing security for any financial firm.

But above all else, AWS is on the cusp of cutting edge machine learning and AI technologies. As one of the longest-running cloud providers, they have gradually improved their AI functionality and have provided more services utilizing them. It serves as the backbone of all AWS features from fraud detection to risk management and better customer segmentation to help employees organize faster.

If security on the cloud is a concern, there are options for hybrid setups to allow for physical security and a number of other security tools on AWS. These aws financial services usually provide data encryption, permissions and access controls for making accounts for management or customers, and threat detection to stop infiltrations in their tracks before the damage is done. AWS meets a number of industry security standards, such as SOC1, SOC2, and PCI DSS. If anything, AWS services will further improve existing security for any financial firm.

But above all else, AWS is on the cusp of cutting edge machine learning and AI technologies. As one of the longest-running cloud providers, they have gradually improved their AI functionality and have provided more services utilizing them. It serves as the backbone of all AWS features from fraud detection to risk management and better customer segmentation to help employees organize faster.

By Industry

IT for financial services is already important enough with the amount of risk at play. Here’s how AWS can be applied for specific parts of finance:

Banking

The primary goal for banking on AWS is to increase overall revenue, minimize costs, improve overall the customer experience, and maintain confidentiality. With financial concerns such as credit score accuracy or financial crimes, AWS can help improve the flow of information through intelligence and automation. As the market shifts and new technologies and regulations are introduced into the field, the cloud provides options for rapid modernization. Data and analytics will not only strengthen customer relations but provide customers with more accurate information to work with.

Capital Markets

With how AWS handles data, there are ways to improve how research and risk are evaluated and how surveillance and reporting are conducted. The cloud is better suited to reallocating resources for higher-value jobs and reducing technical debt along with the AWS standard of agility and scalability. The way the cloud can minimize costs can help improve risk evaluation further than previously thought possible. Taking in heaps of customer data, offers can be summarily spun in ways buyers will find much more appealing.

By Industry

IT for financial services is already important enough with the amount of risk at play. Here’s how AWS can be applied for specific parts of finance:

Banking

The primary goal for banking on AWS is to increase overall revenue, minimize costs, improve overall the customer experience, and maintain confidentiality. With financial concerns such as credit score accuracy or financial crimes, AWS can help improve the flow of information through intelligence and automation. As the market shifts and new technologies and regulations are introduced into the field, the cloud provides options for rapid modernization. Data and analytics will not only strengthen customer relations but provide customers with more accurate information to work with.

Capital Markets

With how AWS handles data, there are ways to improve how research and risk are evaluated and how surveillance and reporting are conducted. The cloud is better suited to reallocating resources for higher-value jobs and reducing technical debt along with the AWS standard of agility and scalability. The way the cloud can minimize costs can help improve risk evaluation further than previously thought possible. Taking in heaps of customer data, offers can be summarily spun in ways buyers will find much more appealing.

Insurance

Insurance has historically been a data-driven industry and needs ways to constantly modernize, whether it be through launching new applications or utilizing that data to better serve customers. The ideal goal is to completely replace older solutions with something that is not only more cost-effective and agile but to do it completely from actuarial systems to how records are established. For example, being able to automate the process for claims, underwriting, and conducting service would ease matters for both provider and customer alike. Many of the emerging technologies that Amazon is already making extensive use of can further assist customers in ways that are faster and aimed more accurately at what they need.

Payments and Protection

Fraud is going to be a perpetually evolving crime and the finance industry needs the right tools to remain prepared to handle fraud attempts. Along with having the infrastructure that is resilient enough to handle incoming threats, there should be measures in place to detect and prevent fraudulent payments. To extend safer means for customers to make payments, the open API nature of AWS allows developers to embed payments or provide instant funding options for customers.

Third-Party Assistance

AllCode is a Select AWS Partner with several AWS specialists and professionals on our team. We have had extensive AWS experience in the past working with different clients to produce a number of applications and projects on the Amazon Cloud. If this is something you see helping your business operations, we would be more than happy to discuss this matter further.

Insurance

Insurance has historically been a data-driven industry and needs ways to constantly modernize, whether it be through launching new applications or utilizing that data to better serve customers. The ideal goal is to completely replace older solutions with something that is not only more cost-effective and agile but to do it completely from actuarial systems to how records are established. For example, being able to automate the process for claims, underwriting, and conducting service would ease matters for both provider and customer alike. Many of the emerging technologies that Amazon is already making extensive use of can further assist customers in ways that are faster and aimed more accurately at what they need.

Payments and Protection

Fraud is going to be a perpetually evolving crime and the finance industry needs the right tools to remain prepared to handle fraud attempts. Along with having the infrastructure that is resilient enough to handle incoming threats, there should be measures in place to detect and prevent fraudulent payments. To extend safer means for customers to make payments, the open API nature of AWS allows developers to embed payments or provide instant funding options for customers.

Third-Party Assistance

AllCode is a Select AWS Partner with several AWS specialists and professionals on our team. We have had extensive AWS experience in the past working with different clients to produce a number of applications and projects on the Amazon Cloud. If this is something you see helping your business operations, we would be more than happy to discuss this matter further.